Experian CreditWorks Personal Review 2024

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What is Experian CreditWorks™?

Experian CreditWorks features

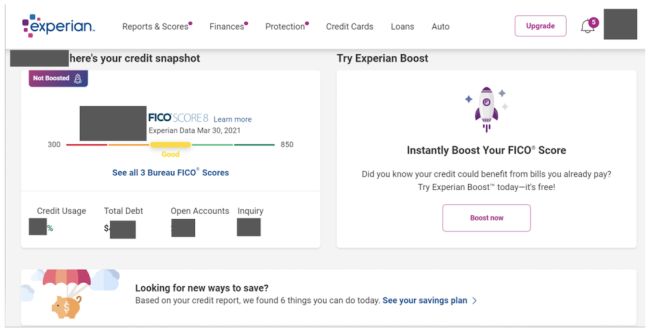

FICO Credit Score

Experian Credit Report

Account balances

Personal finance products

Dark web surveillance, identity monitoring, and fraud protection

Credit card and loan recommendations

Auto insurance quotes

Experian Boost

Experian CreditWorks costs

Feature | CreditWorks Basic | CreditWorks Premium |

Price | Free | $24.99 per month (7-day free trial) |

Credit monitoring and credit score services (updated monthly) | Experian data | Experian, Transunion, and Equifax data |

Daily credit scores | No | Experian |

Credit inquiry monitoring | Yes | Yes |

Account balance change monitoring | Yes | Yes |

FICO Score Simulator | No | Yes |

Feature | Premium | Family |

Price | $24.99/month | $34.99/month |

Identity Theft Insurance | Up to $1 million | Up to $1 million |

Social Security Monitoring | Yes | Yes |

Social Network Monitoring | Yes | Yes |

Quarterly Credit Report | No | Yes |

Daily Credit Score | Yes | Yes |

Identity monitoring for up to 10 children

| No | Yes |

Signing up for Experian

- Full name

- Current address

- Date of birth

- Social security number (last four digits)

- 90-day money-back guarantee

- Free consultation

- 200k happy customers

- 19 years experience

- 11,000+ five-star reviews

How I’ve used Experian CreditWorks to improve my credit

Reviewing my Experian credit report

Flagging incorrect information

Pros and cons

- Free FICO scores and credit reports. If you’re looking to view your FICO score, and gain access to your free Experian credit account, this service is of great value. It’s free and comes with various personal finance tools to help you make smarter money decisions.

- Targeted promotions. Experian CreditWorks offers you credit card and loan deals that you’re a good fit for based on your credit profile. While this service can be helpful for anyone looking for new cards or a personal or auto loan, it’s important to know that Experian makes money off these offerings, so be sure to research before applying.

- Identity protection add-ons. If you’re worried about identity protection, Experian has products catering directly to your needs, ranging from $24.99 per month to $34.99 per month. You will receive basic monitoring with a free CreditWorks account but can upgrade to more advanced identity protection services.

- Steep pricing plans. While I think the free Experian account is worthwhile, the upgraded credit monitoring account that offers you access to Equifax and Transunion data costs $24.99 per month. This seems like a steep monthly price since anyone can request a free credit report once a year by directly reaching out to the credit reporting bureaus.

- Enhanced personal finance tools. Experian’s new and beta-versions of personal finance tools are available for free and can really help you transform your finances. Its Bill Negotiator service can help you lower utility bills quickly, while its budgeting service allows you to better track money going in and out of your bank account. The savings center and credit card perks monitoring options can also help you get the most out of your money.

- No VantageScore access. Two main credit models are used to calculate your credit score — FICO and VantageScore. While both models review your credit use and history, your scores can vary between both methods.

Experian CreditWorks vs. competition

MyFico

Credit Karma

Credit Sesame

- Free Credit Score, Credit Report & Identity Protection

- Simple & Secure. Sign Up In Less Than 90 Seconds

The bottom line

- 90-day money-back guarantee

- Free consultation

- 200k happy customers

- 19 years experience

- 11,000+ five-star reviews

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Courtney Johnston is a freelance writer, specializing in finance, travel, and health. She has written for The Chicago Tribune, Benzinga, BestReviews, Mashvisor, Fundera, MoneyGeek, and The Culture Trip. She also teaches writing instruction at the University of Indianapolis. Courtney currently resides in Indianapolis.